: complete and effortless accident protection

: complete and effortless accident protection

Our Sentinel+ plan provides comprehensive coverage up to $500,000 in case of a fatal accident; however, the protection doesn’t end there. There are payouts in case of covered serious injuries as well as additional benefits like rehabilitation and day care support.

With no medical exams and no health questions asked, our application process was created to provide a stress-free, easy and seamless experience.

What is

?

?

Sentinel+ is an accidental death life insurance plan. Which means that if you pass away as a result of an accident your chosen beneficiaries will receive a tax-free lump sum payment. This plan goes beyond providing a death payout, by offering additional coverage and benefits.

Why do I need it?

Life insurance payout can act as a financial safety net for your family by replacing your income if you are gone. This money can help cover daily living expenses, such as groceries, rent, or mortgage payments, ensuring your loved ones maintain their standard of living. It's a way to provide for your family's future, even in your absence.

For many Canadian families, a mortgage is the biggest debt they carry. If something happens to you, can your family still handle the monthly payments? Life insurance can provide a safety net, making sure your loved ones can continue to make those payments, protecting them from debt and the risk of losing their home.

The death benefit can provide essential financial support by settling outstanding debts, including credit card balances, lines of credit, auto loans, and personal loans. This ensures your loved ones are not stressed by these financial obligations if you're gone.

A life insurance payout can serve as a financial safety net for your children, ensuring that funds are available for their post-secondary education. This payout can cover tuition fees, textbooks, accommodation, and other education-related expenses. It's a way to invest in your loved ones' potential, to help achieve their career goals, even in your absence.

Key Features Setting Our

Plan Apart

Plan Apart

Comprehensive protection – no barriers

Get up to $500,000 coverage regardless of your health or medical history. As long as you are a Canadian citizen or permanent resident between the ages of 18-70 you are approved.

Guaranteed premiums

Your premiums are determined during the application and are guaranteed to never increase. Life is full of surprises; rate hikes shouldn’t be one of them.

Additional coverage for serious injuries

Beyond offering a financial safety net in the event of a fatal accident, this plan also pays out benefits for serious covered injuries, ensuring a comprehensive protection for you and your family. CLICK HERE for a complete list

Even more benefits

In addition to death and serious injury payouts, this plan includes additional benefits for the policy holders and their families such as hospitalization benefit, rehabilitation benefit, day care benefit and more. CLICK HERE to see all the benefits provided.

Sentinel+ is offered exclusively through Specialty Life Insurance and is underwritten by Humania Assurance.

What Our Clients Say

Getting Insured is as Easy as A-B-C

-

Request a Quote

Simply fill out our online quote request form in under a minute!

-

Customized Advice

Our caring, certified advisors will assess your needs and provide a personalized quote.

-

Secure Your Policy with Ease

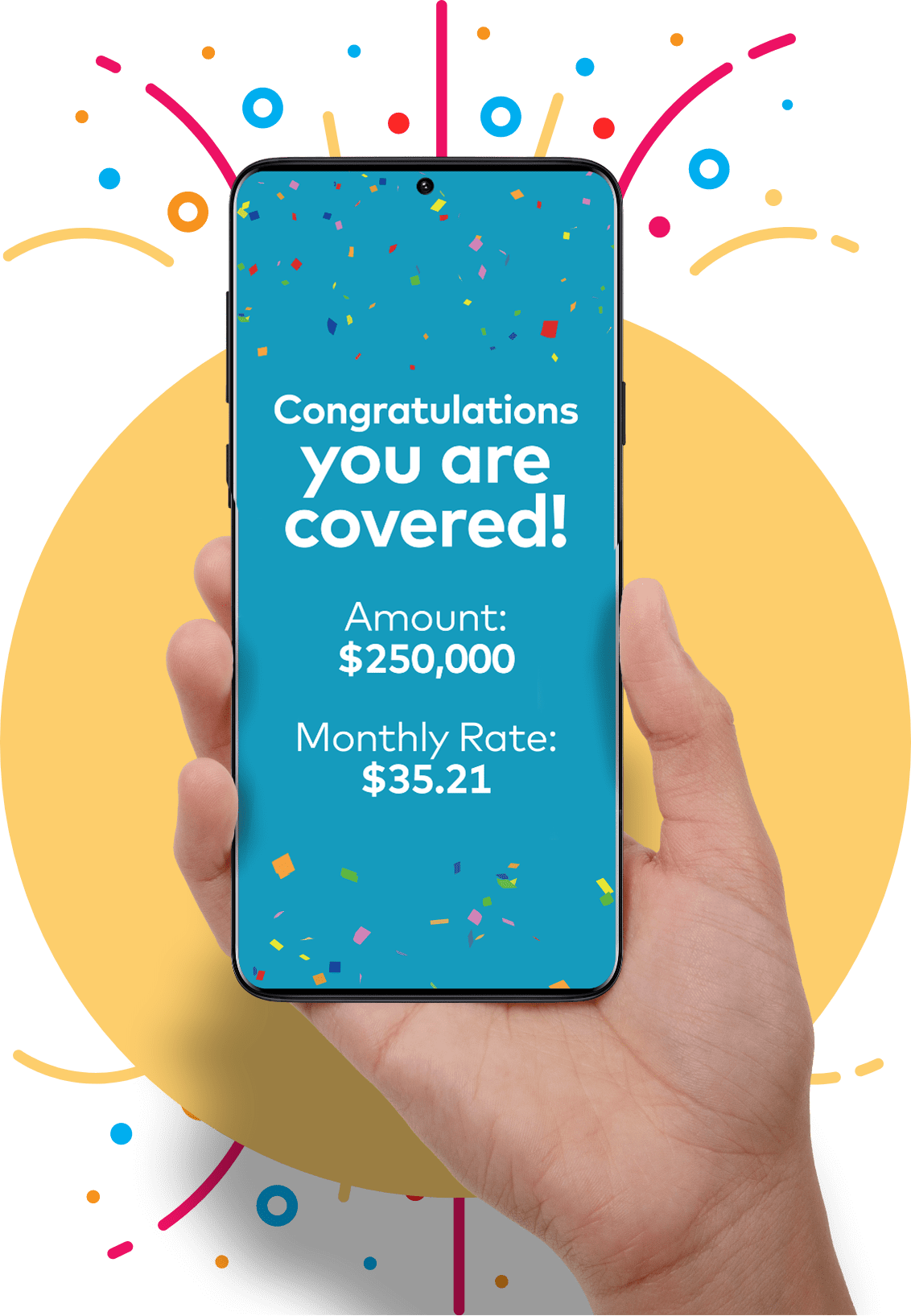

Happy with the details? Let's complete the process. The application is swiftly handled over the phone, with your policy delivered directly to your email. Alternatively, we can send a printed copy to your address. And just like that, you're covered!

Top questions Canadians ask about Accidental Death Insurance

What is Accidental Death Insurance and how does it differ from other types of insurance?

Accidental Death Insurance will pay a benefit to the beneficiary if the policy holder passes away as a result of an accident within 90 days from the day of the accident. Unlike other life insurance plans that can provide a benefit in case of natural death, sickness and accidents Accidental Death Insurance only pays out in case of an accident.

Who can qualify for Accidental Death Insurance?

Canadian citizens and permanent residents aged 18 to 70 can qualify for this plan regardless of health or medical history.

Permanent residents must reside in Canada for at least 6 months to be eligible.

How much does Accidental Death Insurance cost?

This is one of the most affordable types of life insurance on the market, since it is limited to covering accidental death. The cost will depend solely on amount of coverage. Your age, gender, smoking status or health have no effect on the premiums.

How long does Accidental Death Insurance coverage last?

This plan will provide protection up to the age of 75.

What qualifies as an ‘accidental death’?

Accidental death is defined as death that occurs solely as a direct result of violent, sudden and unexpected action from an outside source.

Does Accidental Death Insurance provide a benefit if the accident was not fatal?

Yes, this plan provides coverage on case of serious injury. To see a complete list of covered injuries and % of benefit that would be payable please CLICK HERE.

Who should consider Accidental Death Insurance?

It's often considered by individuals who might not qualify for traditional life insurance due to health issues, those seeking additional coverage on top of their life insurance, or individuals in high-risk jobs.