Effortless and Affordable Lifetime Insurance Coverage

For Canadians who want to ensure their long-term commitments are taken care of, permanent life insurance can offer a lasting peace of mind.

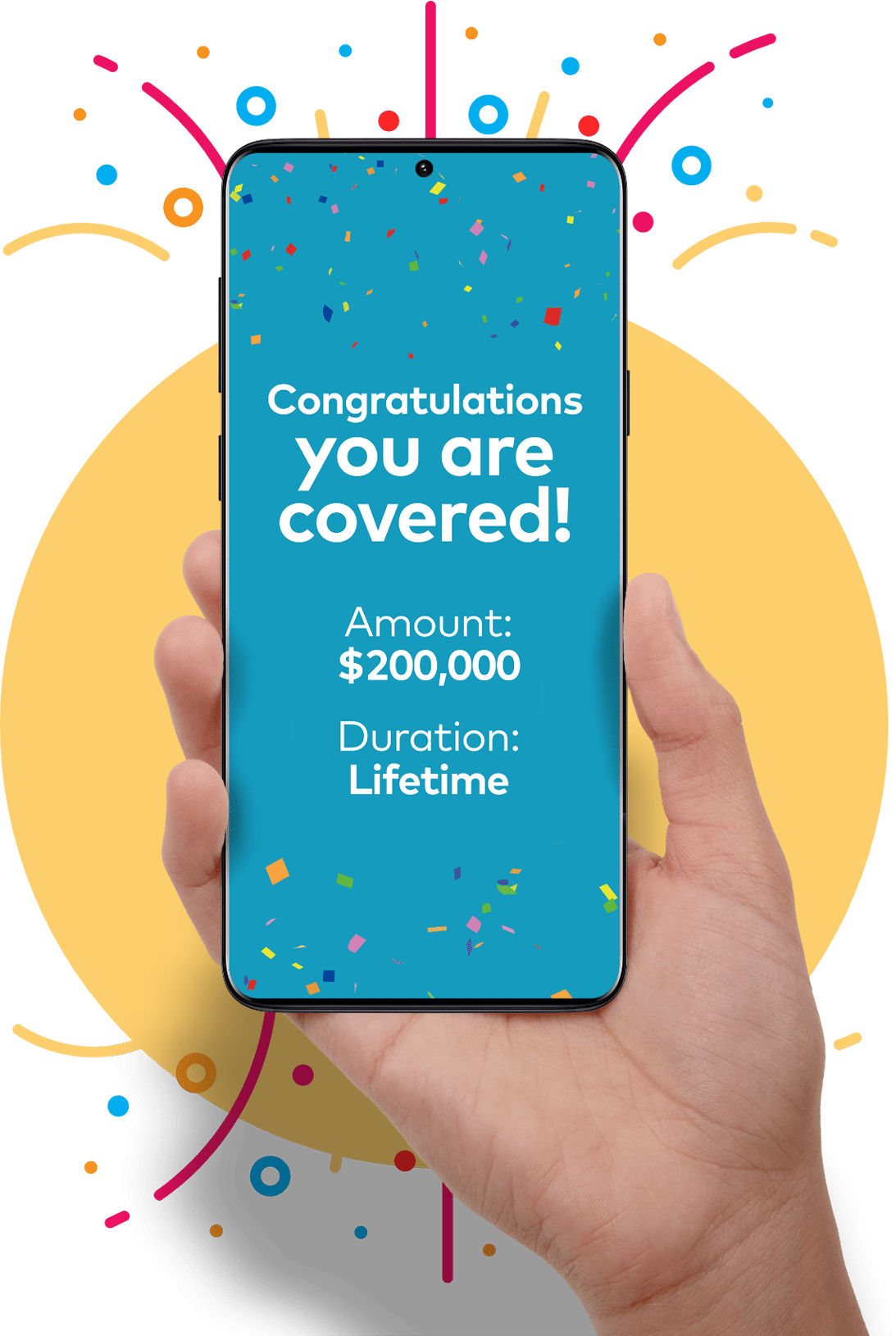

Our Paramount Term 100 plan combines comprehensive coverage of up to $500,000 with a simple and straightforward application that delivers on-the-spot approval.

With no health exams, medical records requirements, or complex paperwork, you are ensured a stress-free journey to lifetime protection.

What is Term 100?

Term 100 Life Insurance is a type of permanent life insurance. Which means your loved ones are protected for a lifetime. When you pass away, a tax-free lump sum payment is paid out to your beneficiaries.

Why do I need it?

If your family relies on your income, the payout can ease financial hardship by covering everyday expenses, bills, and more, to ensure they maintain their quality of life.

Funeral expenses and other final costs can put a significant financial burden on your family. A life insurance payout can make sure your loved ones are left with cherished memories, rather than the worry of settling debts.

If your partner relies on your Old Age Security (OAS) and the Canada Pension Plan payment, a life insurance benefit can provide an alternative source of income to ease any financial strain.

A life insurance benefit can help pay your estate taxes and related costs if you pass away. It's a practical way to ensure that loved ones can inherit your estate without worrying about large tax bills, making the transfer of assets smooth and stress-free.

If you are a business owner, your passing can result in outstanding business loans or debts falling on your family. A life insurance benefit can help deal with these financial hardships. To learn more about why life insurance is important for business owners, CLICK HERE.

Unsure if Term 100 is the right choice for you?

Talk to our friendly licensed advisors today for a free, no pressure consultation.

SPEAK WITH A SPECIALISTKey Features Setting Our Paramount Term 100 Plan Apart

Robust coverage

Enjoy one of the most substantial coverage options available — up to $500,000* — with no need for medical exams or doctors' reports.

Effortless Process

We streamline everything from the application to receiving your policy and accessing support, ensuring an easy and stress-free experience.

Guaranteed Premiums

Your premiums are guaranteed to remain unchanged, providing you with the certainty that there will be no unexpected costs in the future.

Cancer and Accidental Death Add-Ons

Enhance your coverage with our optional Cancer add-on, providing up to $50,000 in financial protection in case of a cancer diagnosis. Plus, our Accidental Death add-on offers an extra layer of security in case of accidental death.

Paramount Term 100 Life Insurance is offered exclusively through Specialty Life Insurance and is underwritten by Humania Assurance.

What Our Clients Say

Applying Is As Simple as A-B-C

-

Apply Online

Complete a quote request on our website in less than a minute!

-

Personalized Consultation

Our compassionate, licensed advisors will work with you to tailor a plan that fits your needs and budget. After a brief health questionnaire, we'll provide you with a competitive quote and a coverage plan tailored just for you.

-

Finalize With Confidence

Happy with the details? Let's finalize it. The application is completed quickly over the phone, and before you know it, your policy will be sent straight to your email. If you prefer, a hard copy can also be mailed to you. Just like that, you’re insured!

Top questions Canadians ask about Term 100 Life Insurance

What is term 100 life insurance?

Term 100 is a form of permanent life insurance. Permanent life insurance does not expire as long as the premiums are paid and provides a payout to the beneficiary when a policyholder passes away.

How does term 100 life insurance work?

When you purchase this plan, you get lifetime protection, with premiums that never change. Once you reach the age of 100, your premiums stop, but the coverage continues. When you pass away a tax-free lump sum payout is provided to your beneficiary.

What determines my rate for Term 100 Life Insurance?

Your rate is based on the following:

Amount of coverage

Age

Gender

Smoking status

Answers to health questionnaire

Does the rate for Term 100 Life Insurance change over time?

Absolutely not, your rate is guaranteed to stay level throughout the duration of your policy.

How does the cost of Term 100 Life Insurance compare to other types of life insurance?

Term 100 is much more affordable compared to other types of permanent life insurance such as Whole Life or Universal Life since there is no cash value or investment component. However, it is more expensive than temporary life insurance such as for example Term 10 Life insurance, since it provides lifelong coverage.

Can I adjust my Term 100 coverage as my needs change?

It depends on the insurance provider. With our policies you can always decrease your coverage as financial commitments change; however, the coverage cannot be increased.

What happens if I miss a premium payment?

A grace period of thirty (30) days is given for missing payments with the exception of the first payment. If the premium is not paid within this grace period the insurance terminates.

Who can be named as a beneficiary and can they be changed?

A beneficiary can be a person such as a family member or a friend, as well as a charitable organization, estate or a trust.

If the beneficiary is minor, a trustee must be provided. The trustee will be responsible for holding the life insurance payout until the minor reaches the age of majority.

When completing an application you will designate the beneficiary revocable or irrevocable. Revocable beneficiary can be changed upon your request. Changing irrevocable beneficiary requires their written permission to be removed from the policy.

Is there cash value available with Term 100 Life Insurance?

There is no cash value accumulation with Term 100 Life Insurance, this is what allows it to be much more affordable compared to other types of permanent life insurance.

Can I cancel my policy and receive a refund of the premiums paid?

You can cancel your policy at any time; however, beyond the initial 10-day review period no refund can be provided.