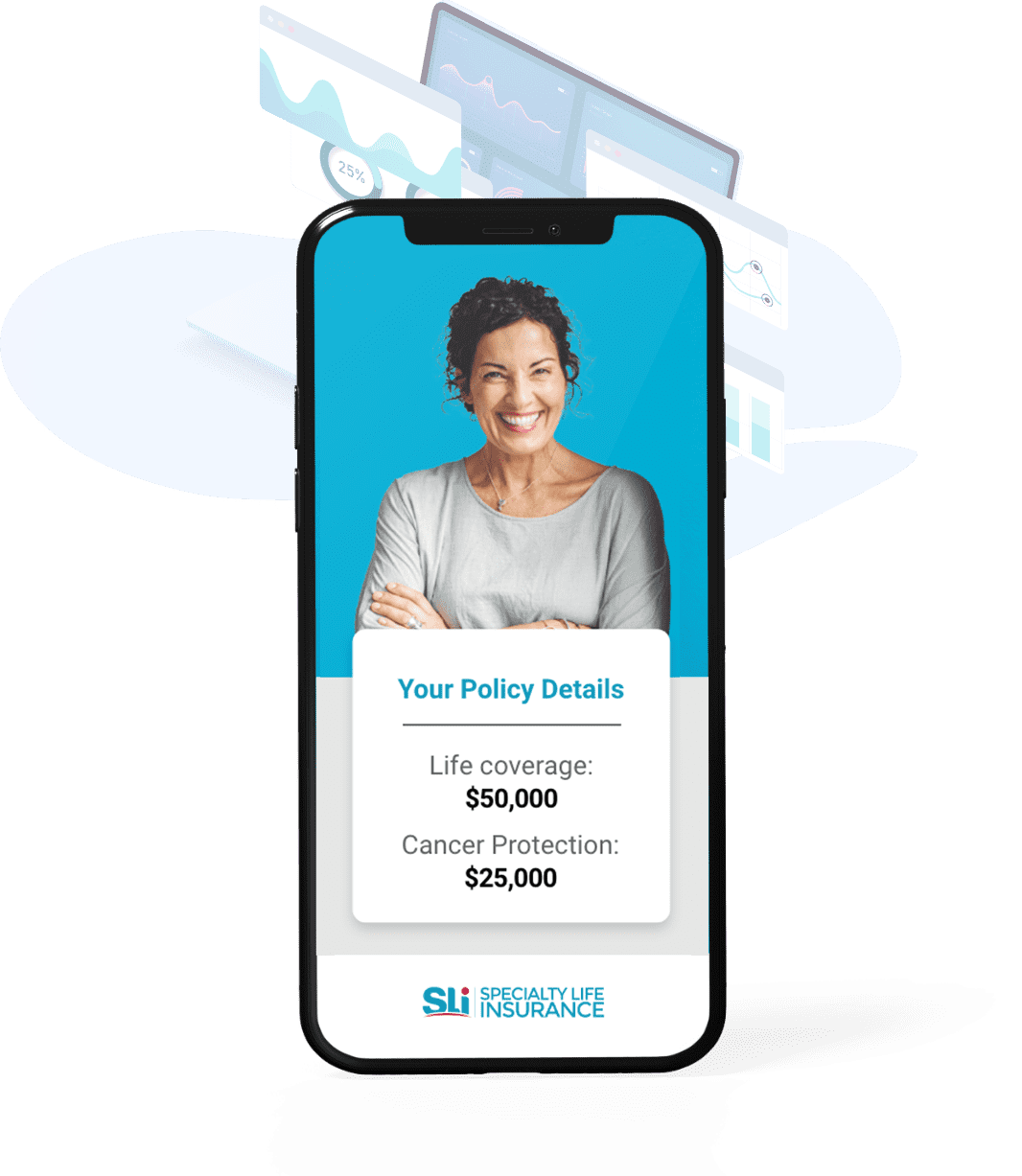

Effortless life insurance with a living benefit

Our life insurance plans give Canadians fast, easy, and affordable access to the coverage they need. Now, we’ve enhanced that protection with an optional Cancer add-on, providing a payout upon a cancer diagnosis—offering you even greater peace of mind.

Key Benefits of Life Insurance + Cancer Protection

Instant approval for robust coverage

Get the protection you need—fast. Secure life insurance coverage from $10,000 to $500,000 with no medical exams, bloodwork, or doctor’s reports. With our simple application process you can qualify and receive your policy the same day.

Cancer Add-on

Enhance your coverage with our optional Cancer Add-On, which provides a lump sum payout of up to $50,000 upon a cancer diagnosis. Use the funds to help replace lost income, cover medical expenses, or ease financial stress during treatment.

Guaranteed premiums

Enjoy peace of mind knowing your premiums are locked in. Both your life insurance and cancer coverage come with guaranteed rates that won’t increase over time.

Flexibility

Choose a term that fits your needs—10 years, 20 years, or lifelong protection. You also have the flexibility to adjust your coverage amount as your needs change. Plus, you can renew your policy or convert it to permanent coverage without additional health questions or medical exams.

These plans are offered exclusively through Specialty Life Insurance and are underwritten by Humania Assurance.

What Our Clients Say

Cancer Protection Highlights

The full benefit amount is paid on diagnosis of major cancer which is defined as "A tumour characterized by the uncontrolled growth and spread of malignant cells and the invasion of healthy tissue, diagnosed by a specialist and confirmed by a pathology test. Types of cancer include carcinoma, melanoma, leukemia, lymphoma and sarcoma."

In other cases of early intervention or minor cancer 15% of the benefit is paid.

You can get coverage ranging from $5,000 to $50,000.

Please note, the maximum cancer protection amount cannot exceed your life insurance coverage. For example, if you have $40,000 in life insurance coverage, your cancer protection cannot exceed $40,000.

Canadian residents ages 18 - 70 are eligible for this coverage.

This policy provides a payout for minor cancer and an additional payout for major cancer in case of a diagnosis later on. The major cancer benefit will be reduced by the amount already paid for the minor cancer.

In the first 2-years of the policy the benefit is not paid out if the cancer diagnosis is caused or related to a pre-existing condition. All premiums paid are refunded.

Got questions about this coverage?

Speak with our licensed advisor for a free consultation and an expert advice.

SPEAK WITH A SPECIALISTWhat can our Cancer Protection do for you

-

Financial Support During Recovery

A cancer diagnosis can lead to lost income due to time off work. Critical illness insurance provides a lump-sum payout that can help cover daily expenses, mortgage payments, or childcare while focusing on recovery.

-

Cover Medical Costs

While our healthcare system covers many cancer treatments, out-of-pocket expenses like medications, specialized care, or alternative treatments may not be fully covered. This insurance helps bridge the financial gap.

-

Protects Savings & Retirement Plans

Without insurance, you may have to dip into savings or retirement funds to cover unexpected costs. A lump-sum benefit ensures your long-term financial goals stay on track, even after a serious illness.

Want to learn more about life insurance?

Our Resource Centre is your go-to guide for understanding life insurance. Whether you are exploring life insurance for the first time or looking to deepen your knowledge, our resources are designed to make complex concepts easy to grasp.

Visit Resource Centre