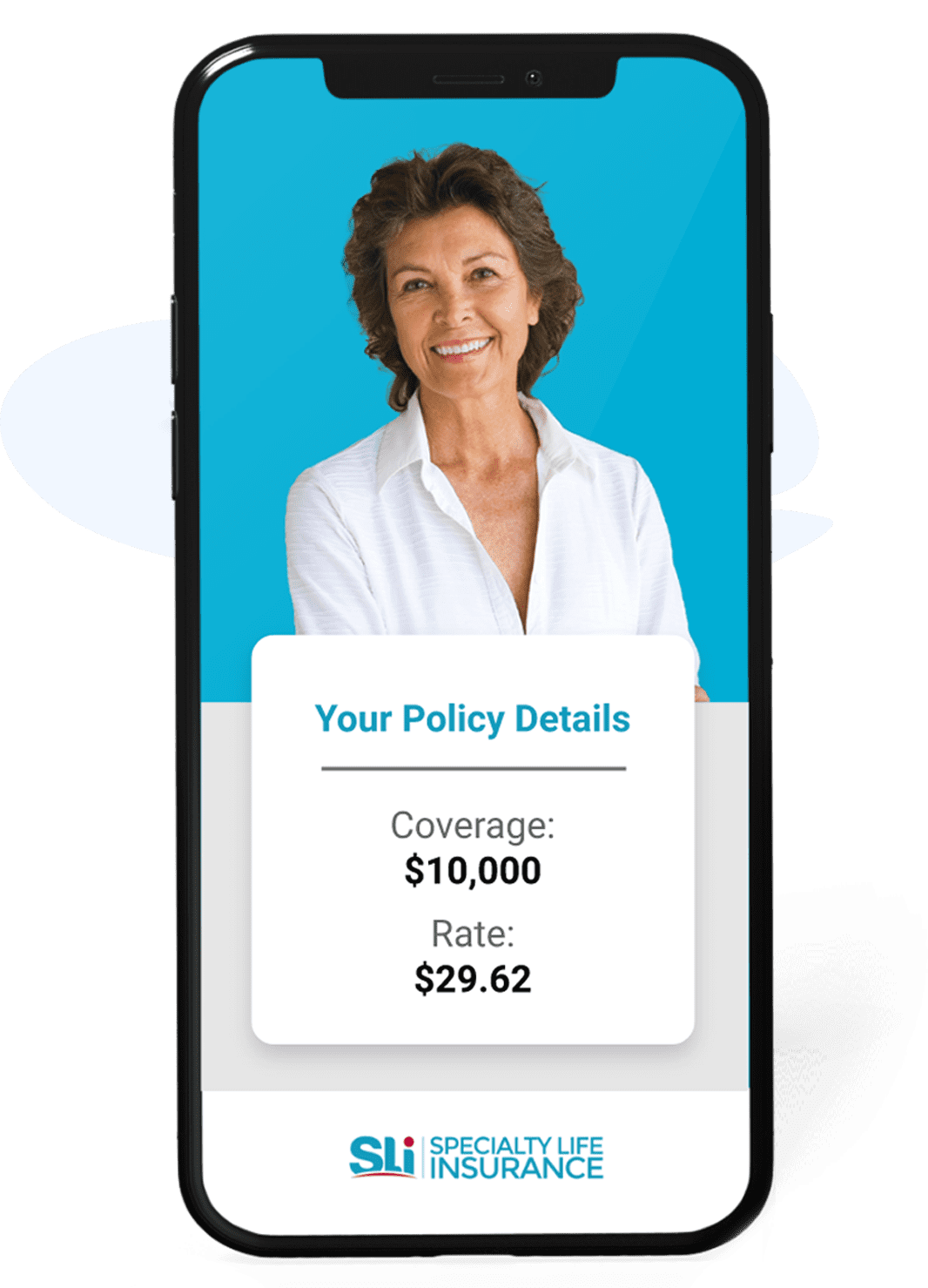

Effortless Life Insurance Coverage for Seniors

Life insurance can be a valuable tool for seniors, as financial obligations often continue well into later years, from helping with outstanding debts to supporting loved ones with final expenses. Our plans are designed with seniors in mind, making it easy and accessible to get the coverage you need, offering peace of mind for you and support for the people who matter most.

Key Features of our Seniors Life Insurance Plans

Permanent Protection

Our plans provide lifetime coverage, ensuring lasting peace of mind.

Fixed Rates for a Lifetime

Your rates are guaranteed to remain the same, so you won’t face unexpected increases down the road.

Pre-existing conditions accepted

We provide options for Canadians with pre-existing conditions, ensuring that your health or medical history won’t prevent you from getting the coverage you need.

No Medical Exams

All of our plans offer simple, paperless application with no medical exams, nurse’s visits or doctor's reports.

These plans are offered exclusively through Specialty Life Insurance and are underwritten by Humania Assurance.

What Our Clients Say

What can Seniors Life Insurance do for your family?

Life insurance can be a meaningful way to support your loved ones during a difficult time, helping cover the often unexpected costs of a funeral—such as the service, burial, and final arrangements. These expenses can quickly add up, creating additional stress when families are already coping with loss. By having life insurance in place, you give your family the reassurance that these costs are taken care of, allowing them to focus on remembering and honoring your life without the added worry of financial strain.

If your partner relies on your Old Age Security and Canada Pension Plan payments to cover daily expenses, this plan’s benefit can serve as an alternative source of income.

The policy proceeds can enhance your estate, providing extra assets to be distributed according to your wishes. This helps ensure your loved ones receive an inheritance, even if other assets are limited.

The tax-free benefit can help cover any remaining debts, such as credit cards, personal loans, or an outstanding mortgage. This ensures that these financial obligations don’t become a burden for your family.

Applying is Easy as 1-2-3

-

Apply Online

Get started with a quote on our website—it takes less than a minute!

-

Personalized Support

Connect with one of our licensed advisors, who will work with you to create a plan that fits your needs and budget. You’ll receive a competitive quote and a coverage recommendation tailored just for you.

-

Finalize with Ease

Ready to move forward? Finalize your application effortlessly over the phone. Your policy will arrive in your email shortly, and if you prefer, we can mail it to you. And just like that, you’re covered!

Want to learn more about life insurance?

Our Resource Centre is your go-to guide for understanding life insurance. Whether you are exploring life insurance for the first time or looking to deepen your knowledge, our resources are designed to make complex concepts easy to grasp.

Visit Resource Centre