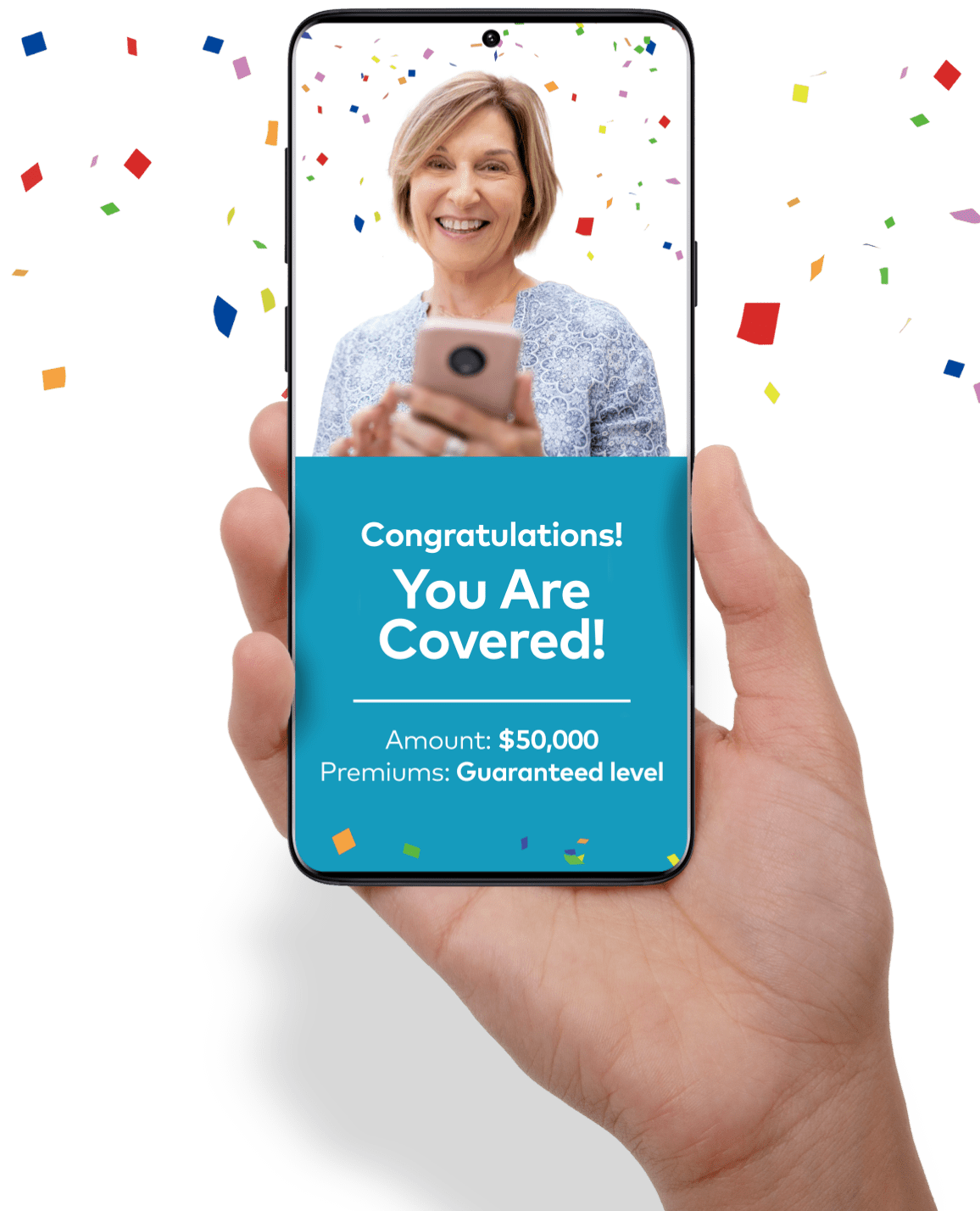

Effortless Life Insurance for Canadians Over 50

Life insurance for Canadians over 50 is a valuable way to provide financial security for your family. Financial obligations such as mortgages, debts and living expenses don’t stop at this stage of life. Our simplified and guaranteed issue plans offer affordable coverage tailored to your needs. We also provide options for individuals with past or current health conditions, ensuring access to the protection you deserve.

Key Features of our Plans

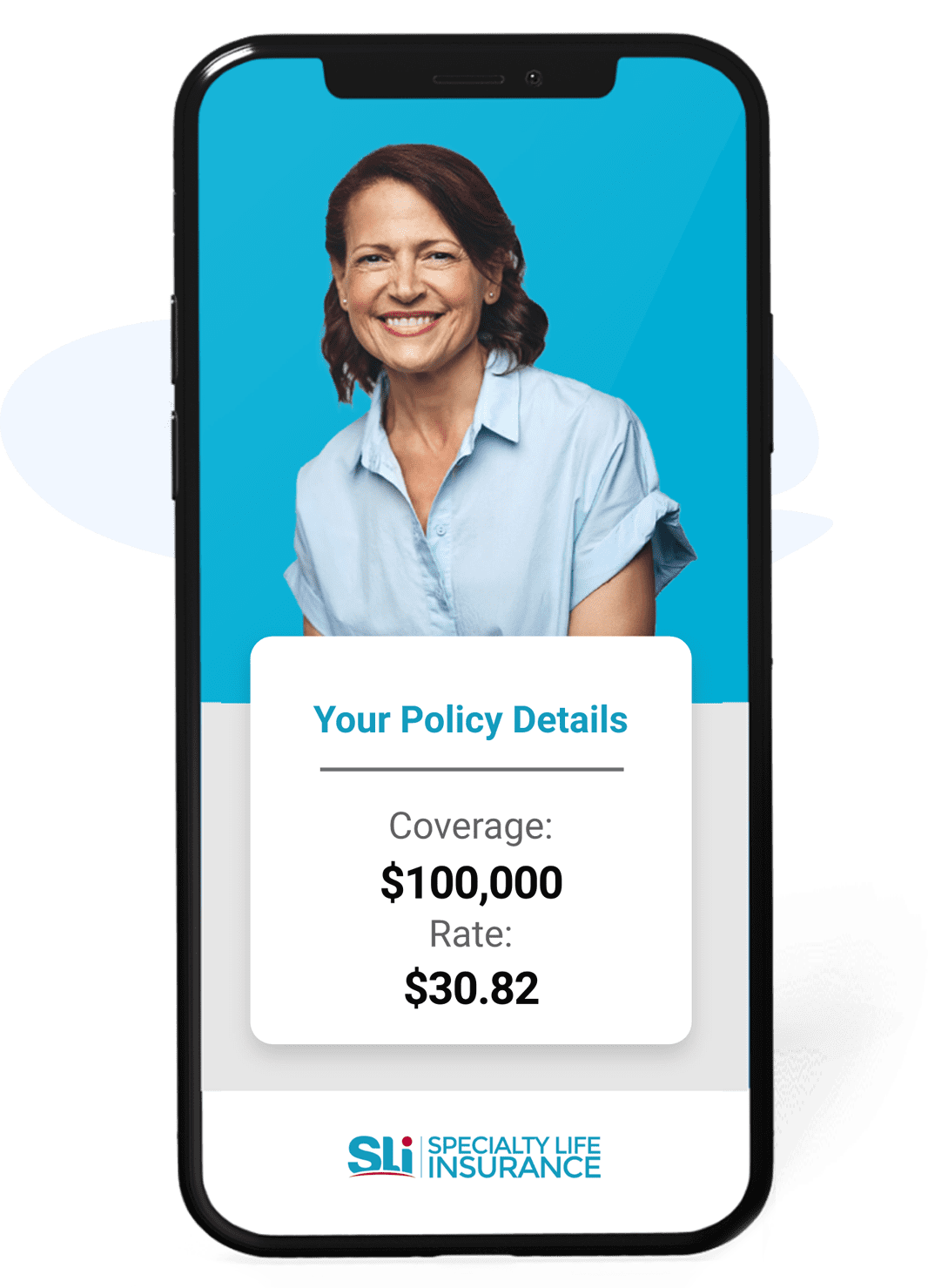

Instant Approval

Get covered quickly and hassle-free. With no medical exams or doctor’s reports required, your application is processed instantly, ensuring immediate peace of mind.

Flexible Coverage Options

Choose the coverage that fits your needs, with flexible protection amounts ranging from $10,000 to $500,000.

Guaranteed Acceptance for Pre-Existing Conditions

No need to worry about past or current medical issues—our plans ensure you’re eligible for coverage regardless of your health history.

Fixed Premiums for Life

Enjoy financial stability with guaranteed premiums that remain the same throughout the entire duration of your policy. No surprises, just consistent protection.

These plans are offered exclusively through Specialty Life Insurance and are underwritten by Humania Assurance.

What Our Clients Say

What can our life insurance plans do for your family?

Many Canadians carry mortgage obligations well into later years. Life insurance ensures this responsibility doesn’t fall on your family. In the event of your passing, a tax-free benefit is paid to your loved ones to help cover or supplement mortgage payments, providing financial security.

If your family relies on your income, a life insurance payout can ease the financial impact by covering everyday expenses like bills, groceries, and other necessities, helping your loved ones maintain their standard of living.

Large debts can become a heavy burden for your family in your absence. A life insurance benefit can be used to pay off outstanding debts, ensuring your loved ones are not left struggling with financial obligations.

Funeral costs can easily reach thousands of dollars, adding financial strain to an already emotional time. Life insurance can help cover these expenses, reducing stress and providing peace of mind for your family during a difficult period.

Applying is Easy as 1-2-3

-

Apply Online

Start with a quick quote on our website—it takes less than a minute to begin your journey toward peace of mind.

-

Get Personalized Support

Work one-on-one with our licensed advisors, who will help you design a plan that suits your needs and budget. You’ll receive a competitive quote along with a customized coverage recommendation tailored specifically to you.

-

Finalize with Ease

When you’re ready to proceed, complete your application effortlessly over the phone. Your policy will be delivered straight to your email or mailed to you if preferred. It’s that simple.

Want to learn more about life insurance?

Our Resource Centre is your-go-to guide for understanding life insurance. Whether you are exploring life insurance for the first time or looking to deepen your knowledge, our resources are designed to make complex concepts easy to grasp.

Visit Resource Centre